[ad_1]

Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Examine. The Examine tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. I’ve compiled the historic quantitative goal technical rating information and secondary technical indicators together with the Candy Sixteen Whole Technical Rankings and Weekly Common Technical Rating again to October of 2021. Each week the Research will spotlight the technical modifications of the 16 cryptocurrencies that I observe in addition to particular person highlights on noteworthy strikes in sure cryptocurrencies and Indexes.

I’ve been requested by a number of of my readers to incorporate a technical “Abstract” which beginning subsequent week, will likely be an everyday function within the Weekly Crypto Candy Sixteen Research. Additionally, this week’s Examine is considerably abbreviated as a result of journey commitments of the creator.

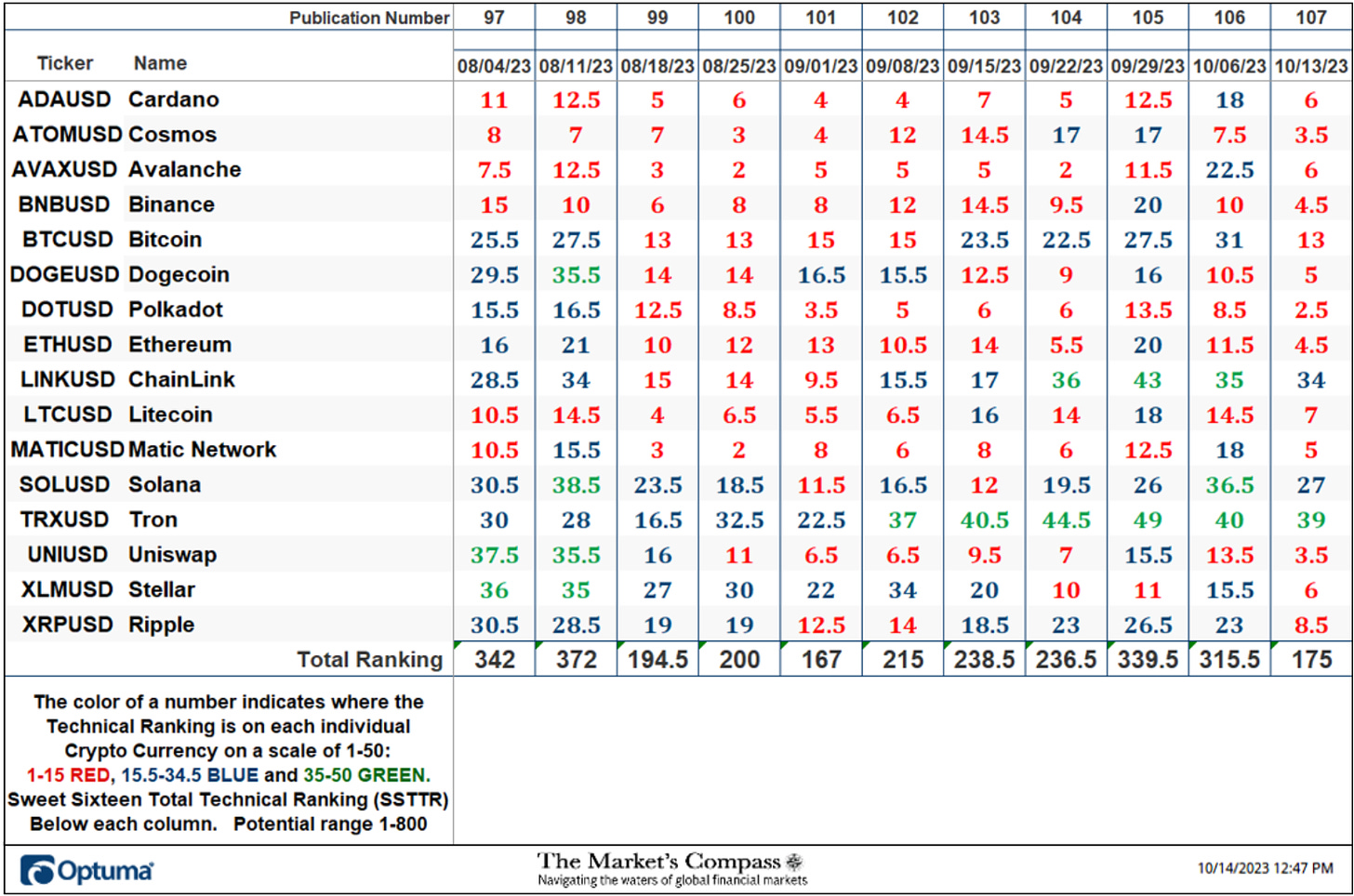

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person Cryptocurrency. The technical rating or scoring system is a wholly quantitative method that makes use of a number of technical concerns that embody however will not be restricted to development, momentum, measurements of accumulation/distribution and relative power. If a person Cryptocurrency’s technical situation improves the Technical Rating (“TR”) rises, and conversely, if the technical situation continues to deteriorate, the TR falls. The TR of every particular person Cryptocurrency can vary from Zero to 50. The spreadsheet under additionally acts as a “warmth map” in that, cryptocurrencies with a TR within the vary of 1 to 15 are highlighted in purple, 15.5 to 34.5 are famous in blue and TRs within the vary of 35 to 50 are in inexperienced. The first take-away from this unfold sheet must be the development of the person TRs, both the continued enchancment or deterioration, in addition to a change in route. A sustained development change must unfold within the particular person TRs for it to be actionable. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity might be considered as an overbought situation however, as we all know, over offered circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply change into extra overbought. Thirdly, the weekly TRs are a useful relative power/weak point indicator vs. one another, as well as when the Candy Sixteen Whole Technical Rating (“SSTTR”), that has a spread of Zero to 800, is close to the underside of its vary and a person cryptocurrency has a TR that continues to be elevated it speaks to relative power. Conversely if the SSTTR is close to the highest of its latest vary and a person cryptocurrency has a TR that continues to be mired at low ranges it speaks to relative weak point. Lastly I view the target Technical Rankings as a place to begin in my evaluation and it isn’t the whole “finish recreation”.

*Rankings are calculated as much as the week ending Friday October 13th

The SSTTR fell -44.53% to 175 from the earlier studying of 315.5 for the week ending October sixth which had fallen barely from the final week in September at 339.5. As will likely be seen within the spreadsheet under the losses in particular person Technical Rankings (“TRs”) was broad based mostly, driving the SSTTR to a stage not seen since September 1st.

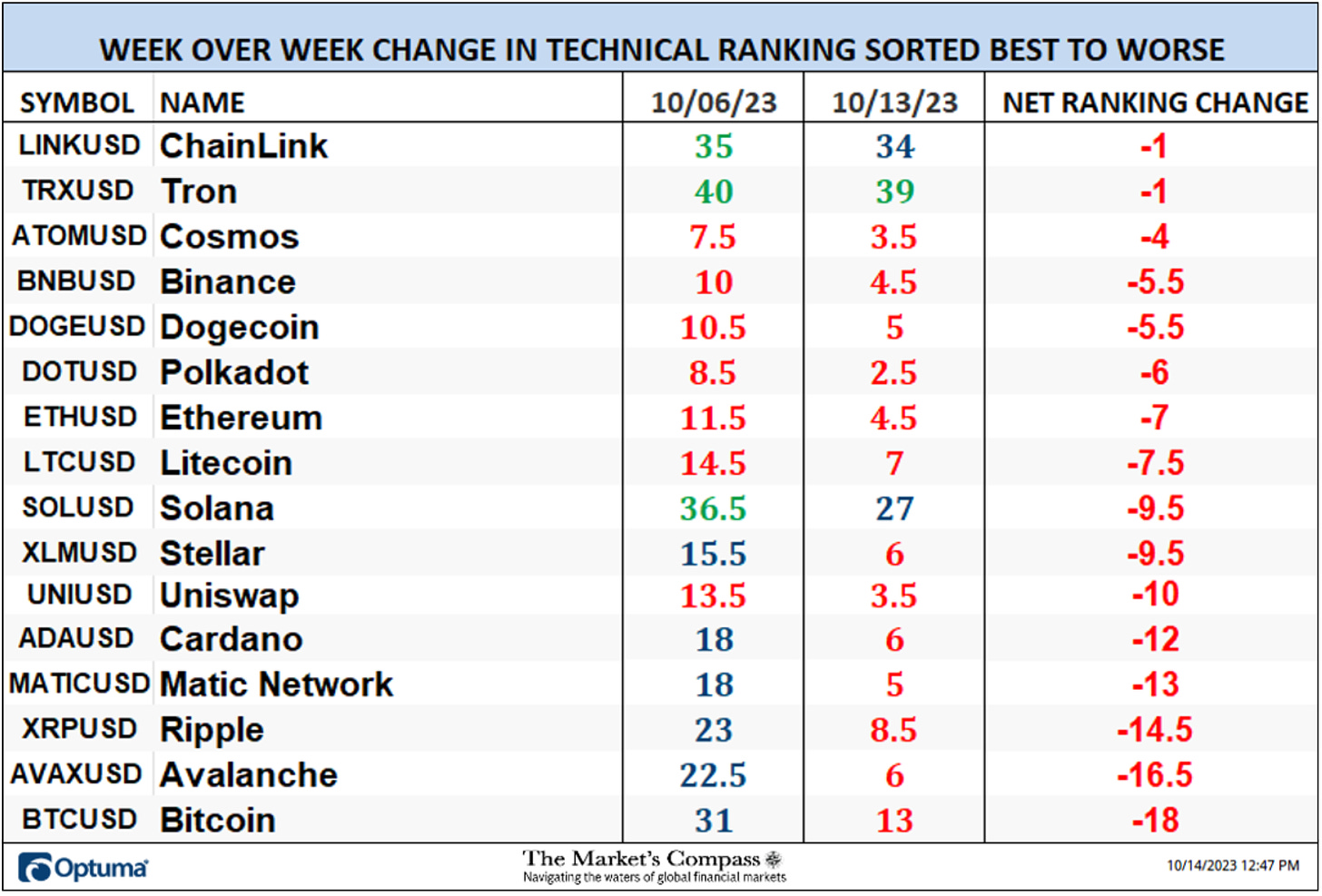

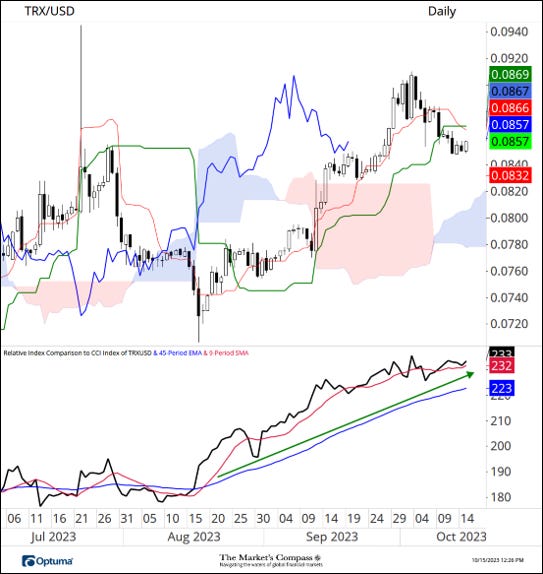

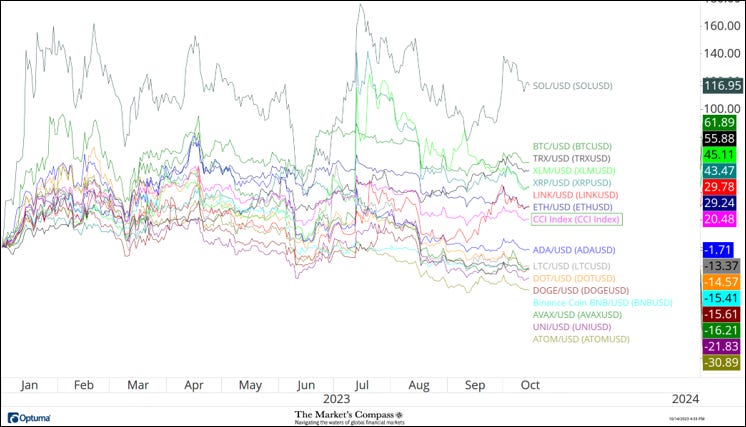

On every week over week foundation the entire Candy Sixteen Cryptocurrencies registered losses of their particular person TRs. The common TR loss was -8.78. Main the sector decrease was Bitcoin (BTC) which misplaced -18 “handles” to 13 from 31 adopted by Avalance (AVAX) which dropped -16.5 to six from 22.5. Solely one of many Candy Sixteen ended the week within the “inexperienced zone” (TRs between 35 and 50). That was Tron (TRX) which noticed its TR solely shaved by -1 to 39 from 40. Two have been within the “blue zone” (TRs between 15.5 and 34.5) and 13 ended the week within the “purple zone” (TRs between 1 and 15). The earlier week ending October sixth, there have been three cryptocurrencies within the “inexperienced zone’ (that included TRX), six have been within the “blue zone” and 7 have been within the “purple zone”. The constructive relative power of TRX vs. the CCi30 Index (inexperienced arrow in decrease panel), since its worth low in August might be seen within the chart posted under.

*Friday October sixth to Friday October 13th

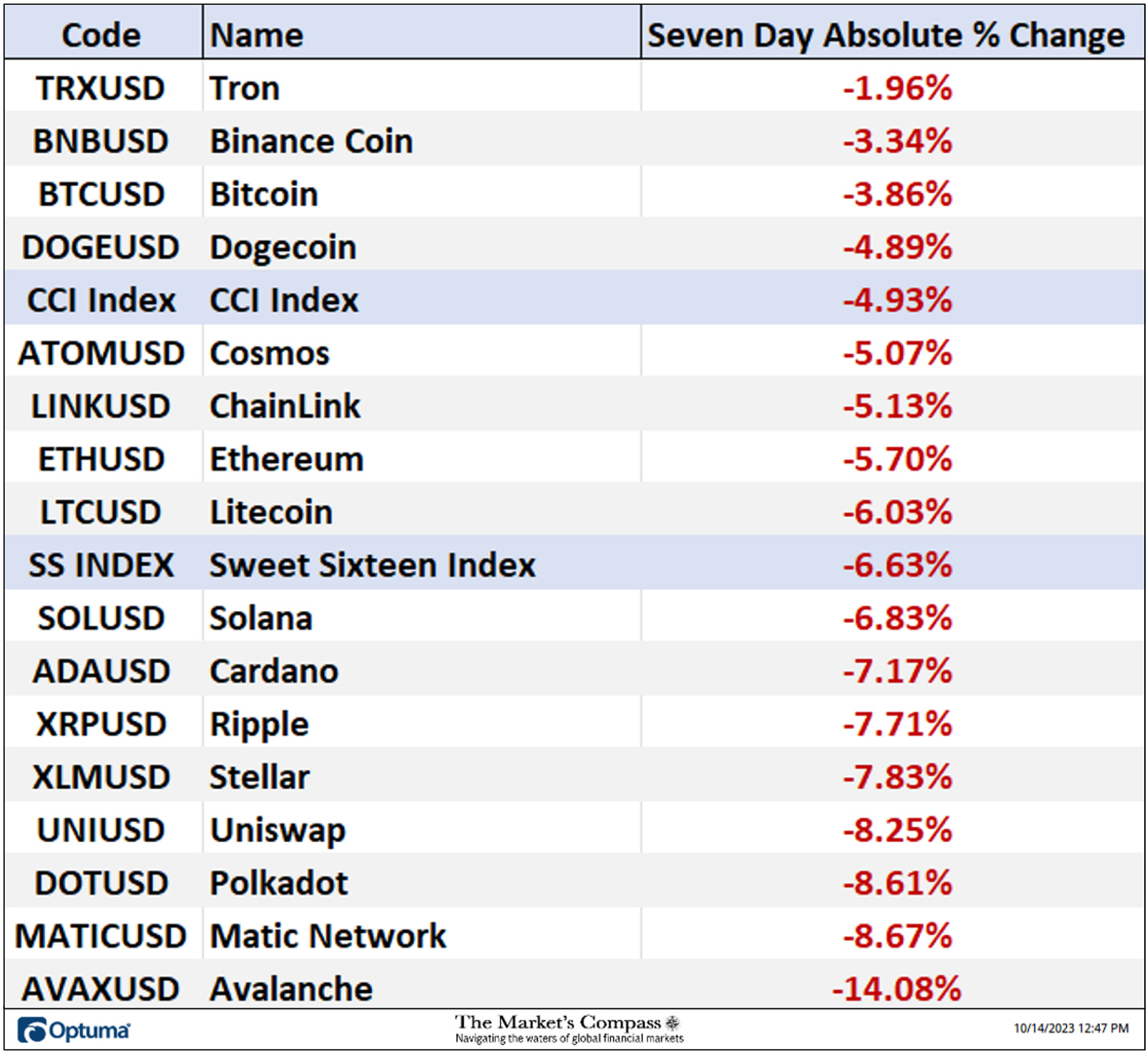

AVAX and Matic Community (MATIC) led the pack decrease with a seven day absolute lack of -14.08% and -8.67% respectively and in doing so serving to to drive the typical seven day absolute lack of the Candy Sixteen to -6.48%. Day by day charts of each are posted under, observe the brief time period lack of worth momentum as witnessed by MACD. TRX’s -1.96% loss nearly appears de minimis in comparison with the losses within the different Candy Sixteen Cryptocurrencies.

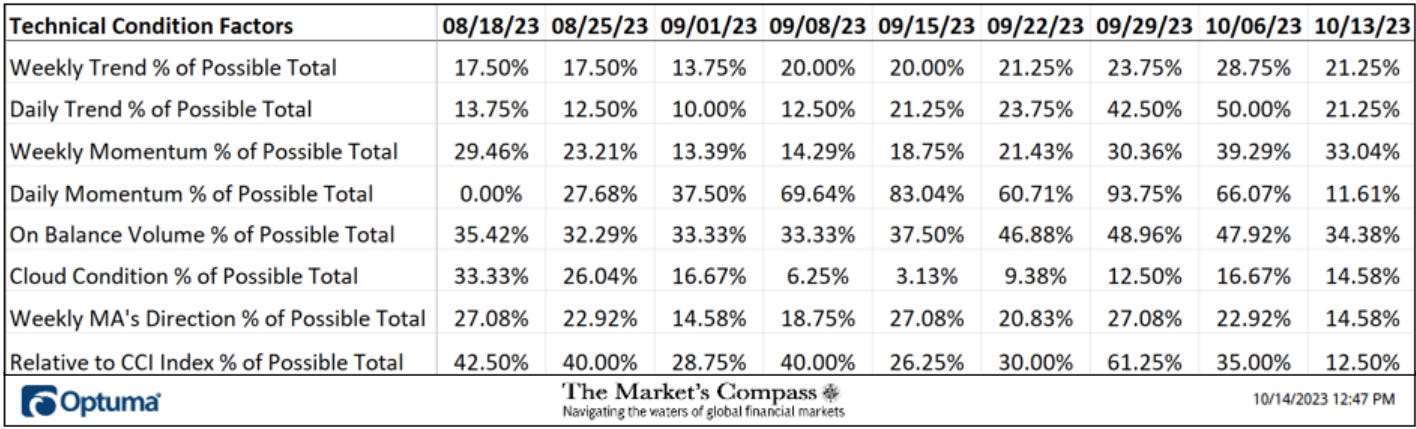

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is constructive an extra level is added to the person TR. Conversely if the technical query is damaging, it receives a “0”. Just a few TCFs carry extra weight than the others such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet above calculates every issue’s weekly studying as a % of the doable complete. For instance, there are 7 concerns (or questions) within the Day by day Momentum Technical Situation Issue (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a doable vary of 0-112 if all 16 had fulfilled the DMTCF standards the studying could be 112 or 100%. A DMTCF studying at 85% and above suggests a short-term overbought situation is growing and a studying of 15% and under suggests a short-term oversold situation.

On the finish of final week the DMTCF fell to 11.61% or 13 out of 112 factors. This week’s oversold studying was a drop from the overbought studying of 93.75% or 105 three weeks in the past.

As a affirmation device, if all eight TCFs enhance on every week over week foundation, extra of the 16 Cryptocurrencies are enhancing internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on every week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week all eight TCFs fell including additional proof of broad based mostly technical weak point within the Cryptocurrency market.

The Candy Sixteen Whole Technical Rating (“SSTTR”) Indicator is a complete of all 16 Cryptocurrency rankings and might be checked out as a affirmation/divergence indicator in addition to an overbought / oversold indicator. As a affirmation/divergence device: If the broader market as measured by the CCi30 Index continues to rally with out a commensurate transfer or greater transfer within the SSTTR the continued rally within the CCi30 Index turns into more and more in jeopardy. Conversely, if the CCi30 Index continues to print decrease lows and there may be little change or a constructing enchancment within the SSTTR a constructive divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the SSTTR will get to the 800 stage (all 16 Cryptocurrencies having a TR of 50) “issues can’t get significantly better technically” and a rising quantity particular person Crypto’s have change into “stretched” there may be extra of an opportunity of a pullback within the CCi30. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of Crypto’s are “washed out technically” and an oversold rally or measurable low is nearer to being in place. The 13-week exponential transferring common in Purple smooths the risky SSTTR readings and analytically is a greater indicator of development.

*The CCi30 Index is a registered trademark and was created and is maintained by an unbiased staff of mathematicians, quants and fund managers lead by Igor Rivin. It’s is a rules-based index designed to objectively measure the general progress, each day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars might be discovered at CCi30.com).

The CCi30 Index fell -4.93% final week after being capped by the Median Line (purple dashed line) of the Schiff Modified Pitchfork (purple P1 by way of P3) for the eighth week in a row. The SSTTR fell as properly and is “closing in” on what has been oscillators low throughout what I proceed to imagine is a base constructing course of. The 13-Week Exponential Transferring Common of the SSTTR continues to trace decrease. MACD of the Crypto Index continues to trace under its sign line at just under impartial territory giving little trace as to the directional bias. Except assist supplied first, by worth assist at 6,580 after which by the Decrease Parallel of the Pitchfork is violated, I’ll follow my technical thesis that the worth motion continues to be base constructing.

The Weekly Common Candy Sixteen Technical Rating (“ASSTR”) is the typical Technical Rating of the sixteen Crypto Currencies I observe on this Weblog. Just like the SSTTR, it’s a affirmation/divergence or overbought/oversold indicator.

The marginally shorter-term Weekly Cloud chart provides little extra technical clues as to the place the index will likely be heading within the weeks that come. What I can say is that with a twist within the Cloud approaching in the course of November there will likely be an opportunity that Cloud resistance will dissipate, decreasing one of many limitations to restoration however the index should first “deal” with resistance at tha Median Line (purple dotted line) of the Pitchfork that has continued to cap rallies). On the finish of final week the ASSTR was approaching a stage that has led to short-term worth reversals.

Charts are courtesy of Optuma whose charting software program allows anybody to visualise any information together with my Goal Technical Rankings. Cryptocurrency worth information is courtesy of Kraken.

The next hyperlinks are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

[ad_2]