[ad_1]

As reported by Fortune Journal, the cryptocurrency market has been experiencing important volatility as Bitcoin (BTC) has skilled a pointy decline that has had a domino affect on different cryptocurrencies. The latest drop within the value of Bitcoin, coupled with outflows from Grayscale’s GBTC, has raised issues amongst traders.

Bitcoin Sees 14% Correction From ATH

Bitcoin suffered a 14% drop since reaching its all-time excessive (ATH) of $73,700 final week, briefly touching $62,483 on Tuesday morning. Nonetheless, it recovered and stabilized round $64,900, slightly below the $65,000 mark.

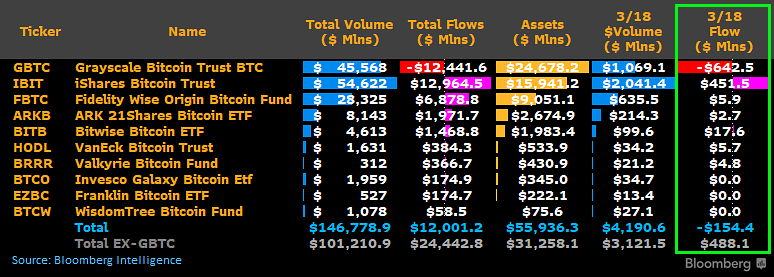

The decline was attributed to report outflows of over $640 million from Grayscale’s Bitcoin Belief (GBTC). Compared, different spot Bitcoin ETFs noticed inflows of lower than $500 million, leading to a web outflow of $15 million on Monday, in accordance to Bloomberg ETF professional James Seyffart.

This outflow from GBTC, mixed with the cautious sentiment surrounding the Federal Open Market Committee (FOMC) assembly within the US, has had a major affect on Bitcoin’s efficiency.

As just lately reported by NewsBTC, traders exhibited warning forward of the FOMC assembly, carefully monitoring the potential adjustments in rates of interest. Latest higher-than-expected inflation knowledge, as indicated by the US Shopper Worth Index (CPI) and Producer Worth Index (PPI), dampened expectations of rate of interest cuts.

Based on Fortune, the CME FedWatch Software projected a 99% chance of charges remaining unchanged, additional affecting market sentiment. Per the report, traders had been eager to gauge the Federal Reserve’s stance on financial coverage, contributing to the cautious buying and selling surroundings.

In the identical context, the Financial institution of Japan raised its key rate of interest from -0.1% to 0% to 0.1% in response to rising client costs. This was the primary price enhance in 17 years.

Crypto Futures Merchants Take A Hit

The drop in Bitcoin’s value had a cascading impact on different cryptocurrencies. Main altcoins like Ethereum (ETH) and Solana (SOL) skilled important declines of 8.1% and 12.5% over the previous 24 hours, respectively.

Meme cash, together with Floki Inu (FLOKI), Bonk Inu (Bonk), and Dogecoin (DOGE), additionally suffered losses of 34%, 28.5%, and 24.8%, respectively, throughout the previous week.

The decline in cryptocurrency costs resulted in over $440 million price of liquidations for merchants of crypto futures. Merchants who had leveraged positions betting on increased costs confronted important losses. Most of those liquidations occurred on Binance, totaling $212 million, adopted by OKX at $170 million.

Regardless of its value correction, BTC retains substantial positive aspects of over 26% and 132% prior to now thirty days and year-to-date timeframe, respectively.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site fully at your individual danger.

[ad_2]