[ad_1]

Decentralized oracle community Chainlink (LINK) has been making important strides within the altcoin market, outperforming its friends with a formidable 44.8% value enhance over the previous 30 days.

Surging to a 24-month excessive, the cryptocurrency has inched nearer to the $20 mark, attracting the eye of bullish buyers. Notably, the uptrend for LINK could also be removed from over, as it may well probably report a considerable 38% value acquire by breaking by way of a essential resistance degree.

Chainlink Buying and selling Quantity Skyrockets

Crypto analyst Ali Martinez signifies that Chainlink faces formidable resistance between its present buying and selling value of $19.40 and $20.03, with 5,330 addresses collectively holding over 8.59 million LINK.

Regardless of this provide wall, if Chainlink manages to interrupt by way of, Ali Martinez means that the subsequent essential resistance degree stands at $26.87, presenting a possibility for a major 38% value surge.

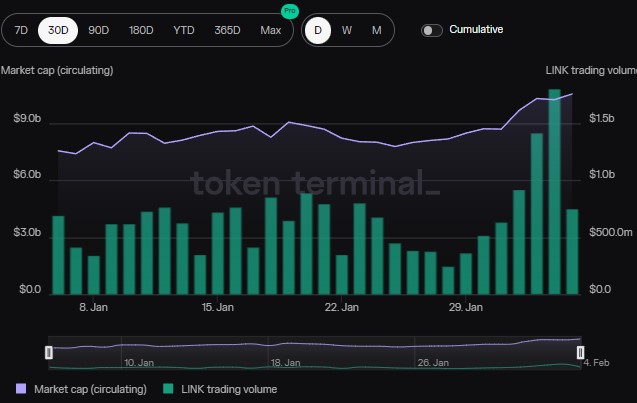

Including to the optimistic outlook, Chainlink has witnessed a surge in buying and selling quantity and a rise in circulating market cap over the previous few days.

Information from Token Terminal reveals that whereas Chainlink’s buying and selling quantity has steadily risen over the previous 30 days, the token skilled distinctive buying and selling quantity of over $9.5 billion previously three days alone. This surge in buying and selling exercise suggests a rising curiosity from buyers within the Chainlink protocol.

Analyzing the circulating market cap, Token Terminal information highlights a optimistic pattern. The circulating market cap of Chainlink stands at $10.53 billion, displaying a notable enhance of 32.66% over the previous 30 days. When it comes to totally diluted market cap, Chainlink information $18.16 billion, indicating a considerable rise of 28.89% over the identical interval.

Institutional Curiosity In LINK?

Current blockchain information means that institutional buyers are actively accumulating LINK. In keeping with Spot On Chain information, the emergence of eight wallets withdrawing a considerable quantity of LINK tokens, coupled with a value surge shortly after, signifies institutional curiosity within the cryptocurrency.

Over the previous twelve hours, eight new wallets, probably representing a single particular person or establishment, have collectively withdrawn 227,350 LINK tokens, equal to roughly $4.12 million on the withdrawal time.

Notably, a good portion of those tokens was withdrawn from centralized exchanges (CEX) simply earlier than the value skilled a sudden enhance of roughly 4.1%. This sample means that establishments might strategically accumulate LINK tokens, anticipating future value appreciation.

Furthermore, as indicated by its efficiency on the algorithmic market scanner Commando, LINK has constantly been a prime performer within the cryptocurrency market.

In accordance to the market intelligence platform Decentrader, with a present rating of 1.83 and a inexperienced sign on low time frames, Chainlink’s technical evaluation suggests a optimistic outlook for the cryptocurrency. Noteworthy is the current breakthrough of Chainlink’s value from a spread held up by the 200-week transferring common (200WMA).

This breakout signifies a shift in market sentiment and a possible upward pattern. The cryptocurrency is now aiming to focus on the “Sniper resistance” degree simply above $20 whereas discovering assist on the prime of the earlier vary, round $16.8, in line with Decentrader.

Total, establishments’ accumulation of Chainlink tokens and the cryptocurrency’s technical breakout level to rising confidence in LINK’s funding potential.

The withdrawals from centralized exchanges counsel a need to carry LINK tokens exterior trade custody, probably indicating a longer-term funding technique.

Presently, LINK is buying and selling at $19.7, up 8% within the final 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.

[ad_2]