[ad_1]

Bitcoin (BTC), the most important cryptocurrency available in the market by buying and selling quantity and capitalization, has launched into a renewed bullish uptrend, reclaiming beforehand misplaced territories and surpassing resistance ranges, igniting optimism amongst buyers.

At the moment buying and selling slightly below its 25-month excessive of $49,000 at $47,900, Bitcoin has skilled a exceptional value enhance of over 6% inside 24 hours and a major 11% surge over the previous seven days.

Mapping BTC’s Path Amidst Pre-Halving Rally

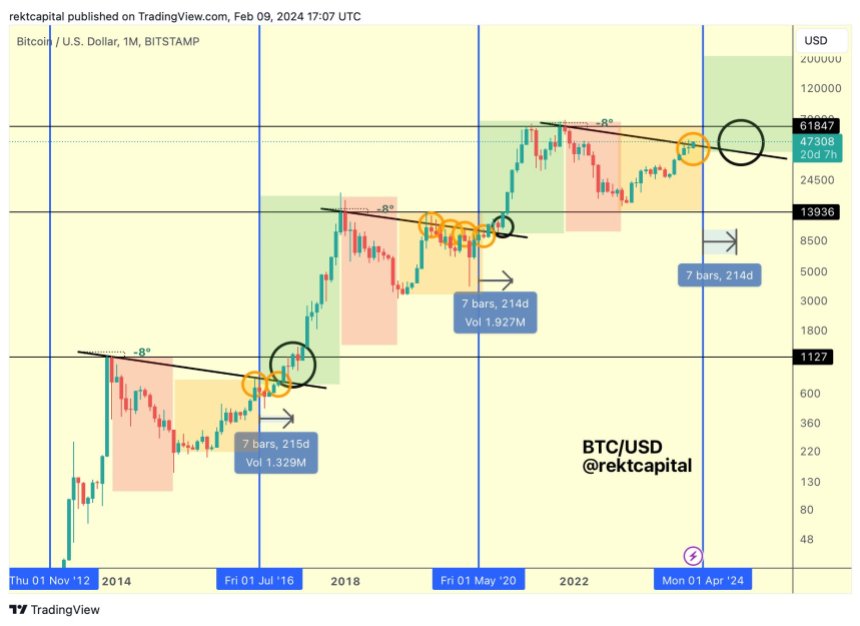

Nevertheless, amidst the market’s pleasure, it’s essential to contemplate historic tendencies and their potential affect on Bitcoin’s trajectory main as much as the upcoming halving occasion. Market knowledgeable and analyst Rekt Capital highlights two noteworthy historic patterns:

Firstly, the “Pre-Halving Rally” section seems to be commencing. This section refers to a interval the place Bitcoin experiences a surge in value earlier than the halving occasion takes place.

Secondly, historic knowledge reveals that Bitcoin has struggled to interrupt past the macro diagonal resistance earlier than the halving, which Rekt locations at $47,000. Moreover, it has encountered problem surpassing its 4 Yr Cycle resistance, which is roughly $46,000 within the present cycle.

It’s value noting that despite the fact that the worth has surpassed these resistance ranges, a consolidation or continuation of the uptrend should be seen, as a retracement may happen and go away the BTC value caught between these resistances.

Given these historic traits, exploring how Bitcoin may probably reconcile these patterns is attention-grabbing. Rekt Capital provides insights into one doable path that Bitcoin may take:

Through the pre-halving rally section, Bitcoin might produce restricted upside, leading to an upside wick on the finish of February. This sample has been noticed in earlier months and 2019.

Following this, Bitcoin would possibly set up one other vary at increased value ranges in March, probably permitting altcoin rallies to take middle stage. Lastly, a number of weeks earlier than the halving occasion, Bitcoin may expertise a pullback, making a pre-halving retrace.

This proposed path means that Bitcoin may surpass the Macro Diagonal resistance with an upside wick however stay beneath it when it comes to end-of-month month-to-month candle closes throughout this progressively concluding pre-halving interval.

Bitcoin Bull Run Indicator Flashing Purchase Sign

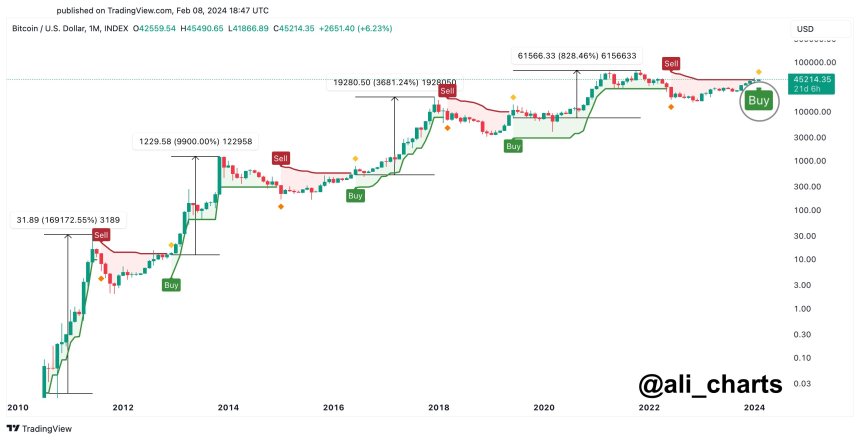

Crypto analyst Ali Martinez has added to the rising bullish sentiment surrounding Bitcoin by highlighting a key indicator that means potential upside motion.

In accordance to Martinez, the Tremendous Development indicator flashed a purchase sign on the BTC month-to-month chart. This software is famend for its precision in predicting bullish traits in Bitcoin markets.

The indicator’s observe document underscores the importance of this purchase sign. Martinez factors out that the Tremendous Development has issued 4 purchase alerts since Bitcoin’s inception, and all 4 have been validated, resulting in substantial good points. These good points quantity to a powerful 169,172%, 9,900%, 3,680%, and 828%, respectively.

Nevertheless, amidst the bullish outlook, Martinez additionally highlights a possible technique that will quickly affect Bitcoin’s value.

In accordance to the Bitcoin liquidation heatmap, a situation is unfolding the place liquidity hunters may drive the worth of Bitcoin right down to $45,810. The intention behind this transfer can be to set off liquidations amounting to a considerable $54.73 million.

You will need to perceive that liquidity hunters purpose to take advantage of value actions to set off pressured liquidations amongst overleveraged merchants. By strategically driving the worth down, they’ll power these merchants to promote their positions, leading to cascading liquidations that probably amplify value downward actions.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.

[ad_2]