[ad_1]

Famend crypto asset hedge fund supervisor Charles Edwards has made a daring prediction concerning the longer term value of Bitcoin. Edwards, founding father of Capriole Investments, shared his insights through X (previously Twitter), outlining a compelling case for Bitcoin’s potential to succeed in $280,000 within the coming 12 months.

In his assertion, Edwards referenced historic information and several other key components that would drive Bitcoin’s value to new heights. He started by evaluating Bitcoin’s efficiency after the 2020 halving occasion, stating, “If Bitcoin’s publish halving returns are the identical as 2020, we’re taking a look at $280Ok Bitcoin subsequent 12 months.”

Bitcoin Value May Prime $300,000 Subsequent Yr

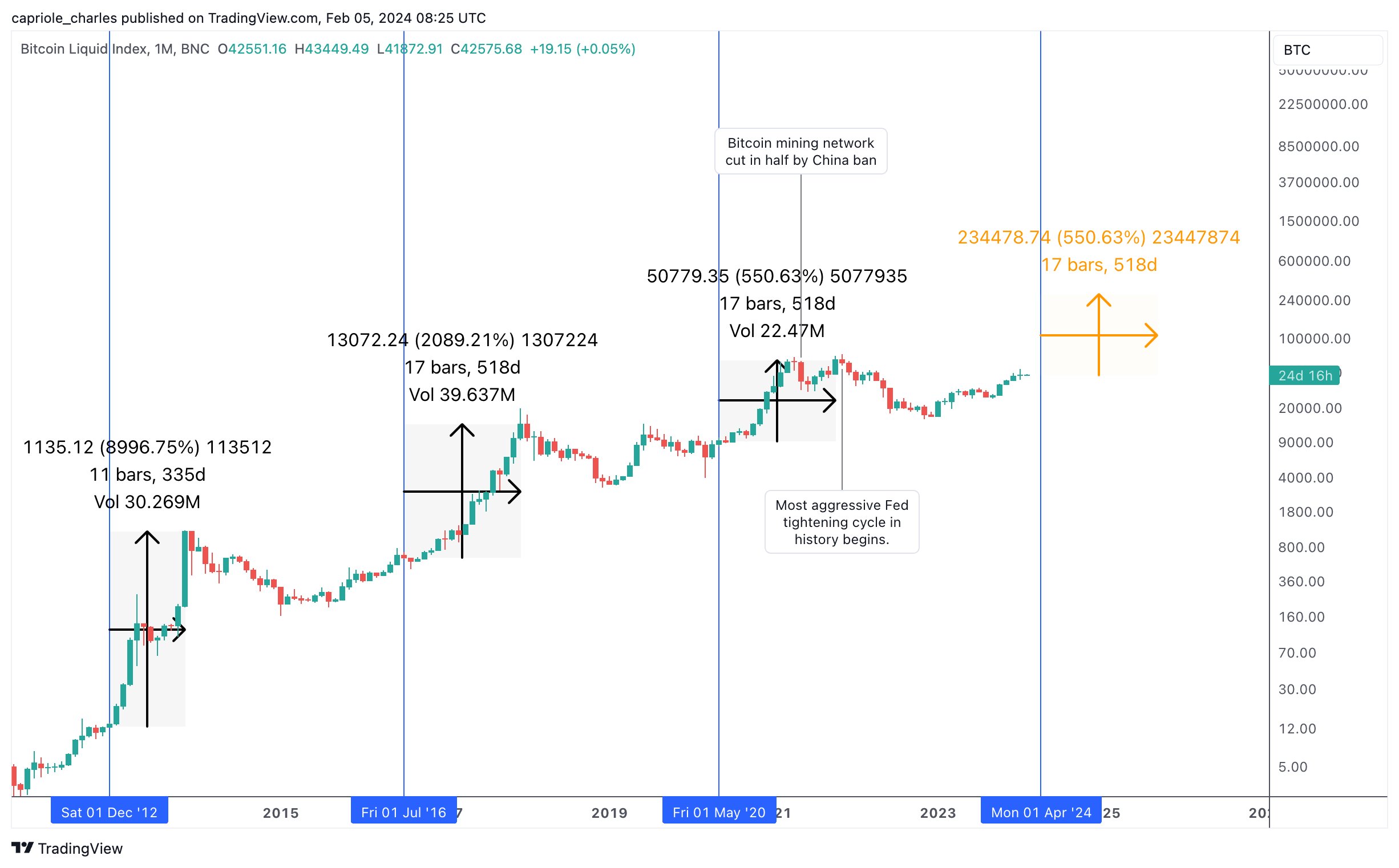

Because the chart by Edwards exhibits, the third bull run in 2020 was quite subdued compared to the earlier ones. The primary bull market (halving cycle) in 2012 noticed Bitcoin value peak at $1132, marking a dramatic improve of 8,996% over 11 months (335 days). The second bull run in 2016 led to December 2017 when the worth reached roughly $20,000, marking a 2,089% improve over 17 months (518 days).

Edwards acknowledged that some would possibly argue that income diminish with every cycle. Nonetheless, he made a counterpoint that 2020’s efficiency was pinned down as a consequence of most important components. First, Edwards attributed the lackluster efficiency of the 2020 bull market to China’s resolution to ban Bitcoin mining, which led to a 50% discount in hash price and had a stifling impact on Bitcoin.

Second, he highlighted the aggressive tightening measures taken by the Federal Reserve, which negatively impacted Bitcoin’s efficiency throughout that interval, stating, “2020 was the worst Bitcoin bull market in historical past. I consider total efficiency was pinned down as a result of -50% destruction of mining community by China and probably the most aggressive Fed tightening cycle in historical past.”

Nonetheless, Edwards expressed optimism concerning the future, pointing to a contrasting financial panorama in 2024. He acknowledged, “In reality, 2024 marks the polar reverse to 2021. QE has resumed and the Fed has began easing, with Fed chair Powell anticipating Three cuts this 12 months. A weaker greenback = a stronger Bitcoin.”

He additionally in contrast the upcoming launch of Bitcoin ETFs in January to a “second halving,” highlighting the potential market influence, saying, “Additional, I take into account the January Bitcoin ETF launches as highly effective as a ‘second halving’.”

Drawing parallels to the gold market, Edwards emphasised that Bitcoin’s present market cap of round $800 billion is considerably smaller than gold’s market cap when the GLD ETF launched in 2004.

He famous that gold skilled a parabolic rise of over 300% in simply seven years following the launch of the ETF, stating, “With a market cap of round $3.3T, Gold commenced a parabolic rise of over 300% to $13T in beneath 7 years. Bitcoin’s market cap in the present day is simply over $800B. Smaller property are usually able to experiencing bigger upside returns.”

Moreover, Edwards underscored the fast progress of Bitcoin, asserting that it’s at present outpacing the adoption price of the Web, saying, “Bitcoin is at present rising sooner than the Web.”

The hedge fund supervisor concluded by summarizing his prediction, stating:

A 500% return over the 18 months following the halving wouldn’t be uncommon for Bitcoin traditionally. An extra 300% return over the following 2-5 years from the ETFs alone can be a conservative assumption. If you drill it all the way down to the 2 most vital components for Bitcoin this cycle, and add them collectively, it’s simple to reach at a conservative Bitcoin value of $300Ok within the subsequent couple of years.

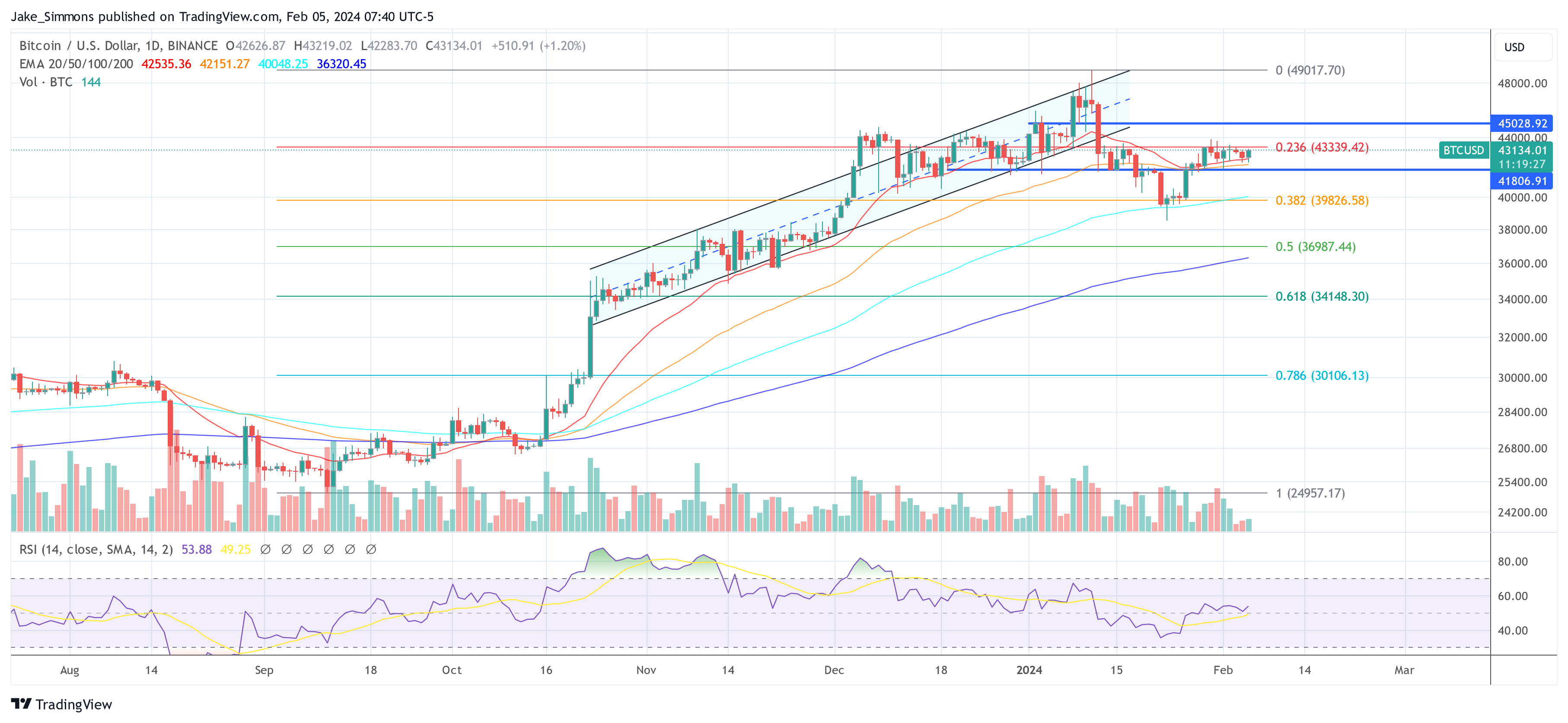

At press time, BTC traded at $43,134.

Featured picture from YouTube / Blockworks, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.

[ad_2]