[ad_1]

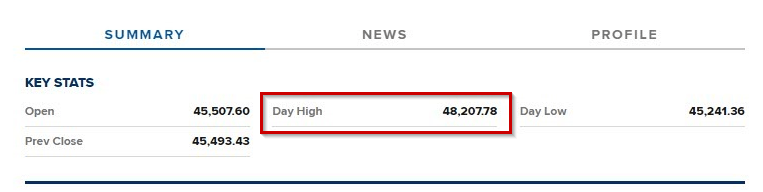

Bitcoin roared again this week, clawing its approach to $48,207 – its highest level since early January. This fiery ascent follows weeks of muted buying and selling, fueled by considerations about institutional outflows and a post-ETF value dip. However what’s sparking this sudden surge? And may the digital dragon overcome its subsequent hurdle?

Constructive Winds Fill Bitcoin’s Sails

A number of components are propelling Bitcoin’s latest rally:

- Spot ETF Momentum: The long-awaited launch of spot Bitcoin ETFs in January is likely to be lastly delivering on its promise. Potential inflows and constructive sentiment surrounding these new funding autos are driving curiosity.

- Halving Horizon: The Bitcoin halving, scheduled for Could 2024, looms giant. Traditionally, this occasion, which reduces the speed of latest Bitcoin creation, has been linked to cost will increase, fueling investor optimism.

- Market Synergy: The S&P 500’s latest ascent to file highs appears to be spilling over to the crypto market, making a wave of constructive momentum.

- Lunar Luck? Bitcoin usually experiences positive factors across the Chinese language New 12 months, and this 12 months isn’t any exception. The “12 months of the Dragon,” with its auspicious connotations, provides one other layer of bullish sentiment.

- ETF Absorption of Promoting Strain: A number of ETFs have absorbed over a billion {dollars} price of Bitcoin promoting stress in latest weeks, indicating underlying demand regardless of pre-ETF considerations.

Bitcoin presently buying and selling at $47,335 on the every day chart: TradingView.com

However Can Bitcoin Slay The Resistance Dragon?

Whereas the outlook appears brilliant, challenges stay:

- Resistance at $48,500: Bitcoin faces an important resistance degree at $48,500. Breaking by this barrier is essential for a possible new all-time excessive.

- Publish-ETF Promote-off: Regardless of the latest surge, Bitcoin stays under its pre-ETF highs, sparking considerations a few potential sell-off after the preliminary pleasure fades.

- Volatility Reigns: Crypto stays a notoriously unstable asset, and predicting future value actions is fraught with issue.

Specialists Weigh In: Bitcoin At $52Okay

Sylvia Jablonski, CEO of Defiance ETFs, attributes the value appreciation to “latest inflows into the spot ETFs, the prospect of the halving, and common market momentum.” Nonetheless, she cautions that breaking by resistance ranges isn’t assured, and traders ought to strategy any funding with warning.

In the meantime, Markus Thielen, the founding father of 10x Analysis and head of analysis at Matrixport, predicted extra rise in bitcoin costs utilizing Elliott Wave principle, a technical examine that makes the belief that costs transfer in repeating wave patterns.

The concept states that value developments evolve in 5 phases, with waves 1, 3, and 5 serving as “impulse waves” that point out the first development. Retracements between the impulsive value motion happen in waves two and 4.

In accordance with Thielen, BTC has begun its closing, fifth impulsive stage of its uptrend, aiming to achieve $52,000 by mid-March, after finishing its wave four retracement and correcting to $38,500.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site fully at your personal danger.

[ad_2]