[ad_1]

For a time early in 2024, the Chevy Bolt EV would be the solely EV from GM qualifying for the complete EV tax credit score.

Sure, that’s a mannequin now out of manufacturing and set to be more and more tough to seek out at dealerships in 2024.

GM did say that the Chevrolet Blazer EV and Cadillac Lyriq are because of regain tax-credit eligibility in early 2024.

“After reviewing Treasury’s long-awaited proposed steerage, we consider the Cadillac Lyriq and Chevrolet Blazer EV will quickly lose eligibility for the clear automobile credit score on Jan. 1, 2024 due to two minor parts,” said GM to Inexperienced Automotive Studies. “Whereas we await last guidelines, GM has pulled forward sourcing plans for qualifying parts in early 2024 and can advocate for our sellers and clients who buy automobiles constructed forward of the brand new steerage.”

For now the difficulty is perhaps associated on to cell separators and electrolytes within the firm’s joint-venture Ultium battery cells, that are themselves made within the U.S. GM added that it expects the Chevy Equinox EV, Chevrolet Silverado EV, GMC Sierra EV, and Cadillac Lyriq made after the sourcing change to be eligible for the complete incentive.

Ford Mustang Mach-E, F-150 Lightning getting CATL LFP batteries

Moreover, Ford confirmed to Inexperienced Automotive Studies that its E-Transit and Mustang Mach-E, at the moment each eligible for $3,750, will lose the credit score fully. The Ford F-150 Lightning and Lincoln Corsair Grand Touring will maintain their credit score quantities of $7,500 and $3,750 respectively.

Why are some EV credit falling to the wayside? Merely put, as sourcing necessities turn into extra granular, qualifying will get much more difficult in a globalized auto business.

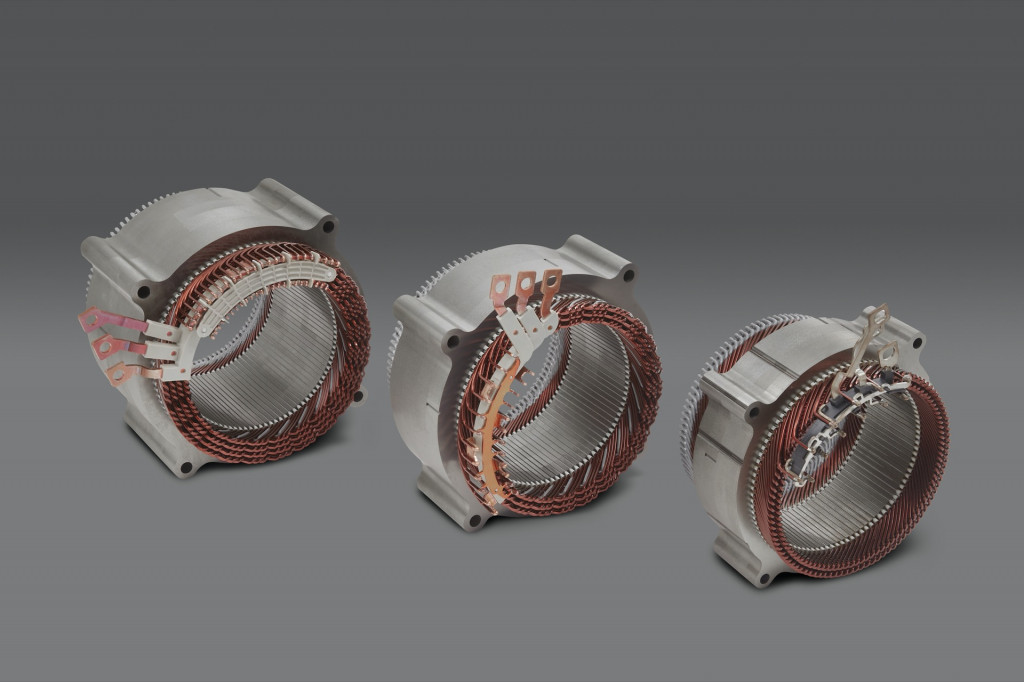

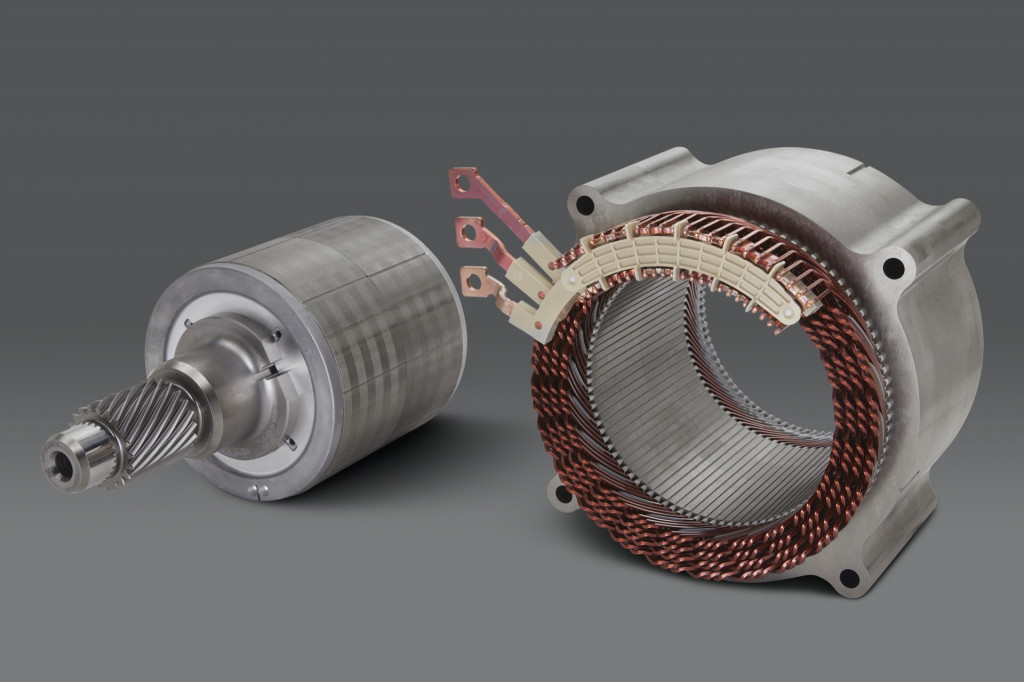

Motor household for GM Ultium-based EVs

There could also be different logistical and sourcing hurdles within the yr forward. As an example, with the Blazer EV, GM assembles the drive models in the identical Ramos Arizpe, Mexico, advanced that builds the Blazer EV itself. GM designed and engineered its Ultium motors in-house, however the permanent-magnet motor used all through the Blazer EV lineup is made by South Korea’s LG at vegetation in China and Mexico.

At GM’s latest media occasion for the Blazer EV, GM assistant chief engineer Patrick Lencioni, who oversees the motor suite that is set to enter numerous its Ultium EVs, defined to Inexperienced Automotive Studies that it’s strategically working with LG in that case “to shift the footprint as wanted,” relying on the sourcing rule.

Motor household for GM Ultium-based EVs

Beginning Jan. 1, the Treasury Division extends the international content material limitation to different “low-value” parts.

It’s the newest peg already put in as a part of the Inflation Discount Act championed by the Biden administration. The EV tax credit score received a whole revamp final yr into the Clear Automobile Tax Credit score, retaining its $7,500 most quantity, and plug-in hybrids retained eligibility with a minimal battery capability. However with household-income and automobile MSRP ceilings utilized, automobiles have to be assembled within the U.S., Mexico, or Canada, and because the years progress, and the content material of the parts inside EVs must be sourced much less from outdoors most well-liked U.S. commerce companions.

Earlier this month the Division of Power made {that a} clearer step with stricter-than-expected sourcing guidelines, together with “international entity of concern” language that excludes EV content material from China, Russia, Iran, and North Korea in manufacturing and meeting or battery parts. That will even prolong out to mining, processing, and recycling of important minerals in 2025. The late launch gave automakers a particularly quick time to react to the tighter calendar-year-2024 guidelines.

2023 Tesla Mannequin Y

GM and Ford aren’t the one ones anticipating to lose tax-credit eligibility. Tesla earlier this month disclosed that the Mannequin Three Rear-Wheel Drive and Lengthy Vary fashions gained’t qualify for the credit score after Dec. 31, whereas simply final week it prompt that some variations of the Tesla Mannequin Y “doubtless” gained’t retain the complete tax credit score quantity.

There’s nonetheless room although for automakers to entry a distinct credit score meant for industrial automobiles that serves as a loophole for EV leasing—offering as much as $7,500 off the general value of the lease, no matter worth caps or content material necessities.

Additionally, beginning in 2024, the tax credit score will turn into an on the spot dealership rebate, with dealerships able to tapping into it on the level of sale, serving to some households to scale back the financed value of latest automobiles. It’s nonetheless as much as households to guarantee their eligibility, although.

UPDATED to incorporate a response and larger element from GM.

[ad_2]