[ad_1]

Rising rents drive down rental affordability

Rental affordability in Australia has plummeted to its lowest level in practically twenty years, marking a big problem for households throughout the earnings spectrum, in response to the PropTrack Rental Affordability Report – 2024.

“Surging rents over the previous few years imply renters throughout Australia are actually going through the worst degree of rental affordability in at the very least 17 years,” stated Angus Moore (pictured above), senior economist at PropTrack.

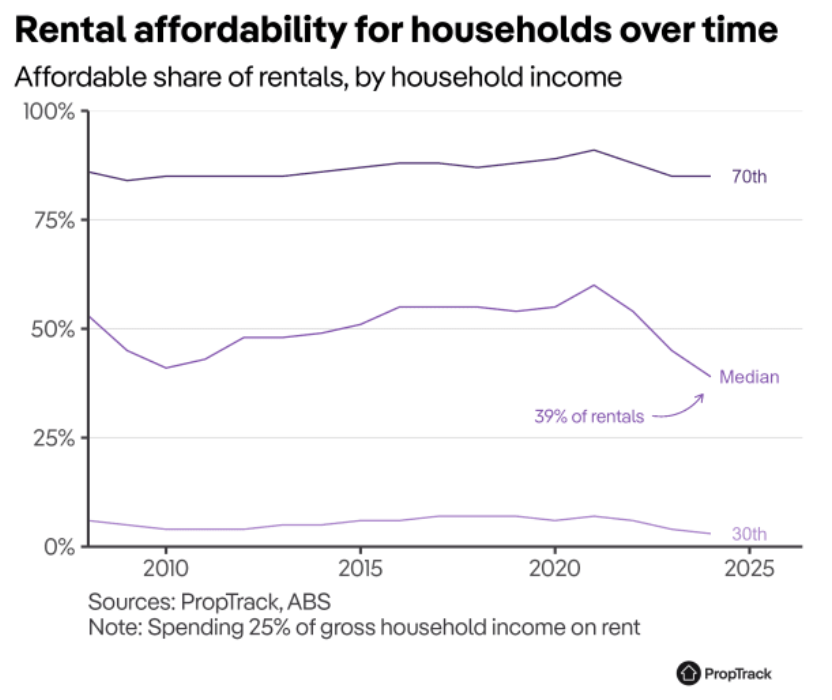

“The PropTrack Rental Affordability Index reveals that, over the six months from July to December 2023, households throughout the earnings distribution may afford to lease the smallest share of marketed leases since at the very least 2008.”

This example represents a big shift from the pre-pandemic interval, the place rental affordability was step by step bettering as a consequence of rents rising at a slower tempo than incomes

Rental affordability worsens throughout the board

The PropTrack report discovered that rental affordability has dramatically declined, significantly in New South Wales, Tasmania, and Queensland, the place households wrestle probably the most to search out reasonably priced rental choices. Conversely, Victoria stays probably the most reasonably priced state for renters, regardless of vital declines in affordability over the previous few years.

The decline in affordability is attributed to a considerable enhance in rents for the reason that pandemic started, which has outpaced wage progress.

The affect on median-income households

The report highlighted a very alarming development for median-income households, which might now afford simply 39% of leases marketed over the latter half of 2023. This represents the bottom share since data started in 2008 and a considerable decline from the extra beneficial situations seen earlier than and in the course of the pandemic.

“Even comparatively high-income households incomes about $170,000 a 12 months — greater than 70% of Australians — are going through tougher rental situations than they’ve in a while,” Moore stated. “These households may afford 85% of marketed leases in 2023-24 – a considerable fraction, however nonetheless the worst since 2008-09, and down from a excessive of 91% in 2020-21.

Surging rents outpace earnings progress

The first driver behind the deteriorating rental affordability is the speedy enhance in rents, which surged by 11.5% in 2023 following a 15.6% progress in 2022. In comparison with the interval earlier than the pandemic, rents nationally are up by 38%, considerably impacting affordability.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day publication.

Sustain with the newest information and occasions

Be part of our mailing listing, it’s free!

[ad_2]