[ad_1]

As Bitcoin (BTC) continues its outstanding ascent, reaching a brand new all-time excessive (ATH) of $72,300, buyers surprise when the present bull market will peak. Contemplating historic information and the upcoming halving occasion scheduled for April 2024, crypto analyst Rekt Capital has supplied insights into potential timing.

Bitcoin Peak Anticipated Sooner Than Anticipated?

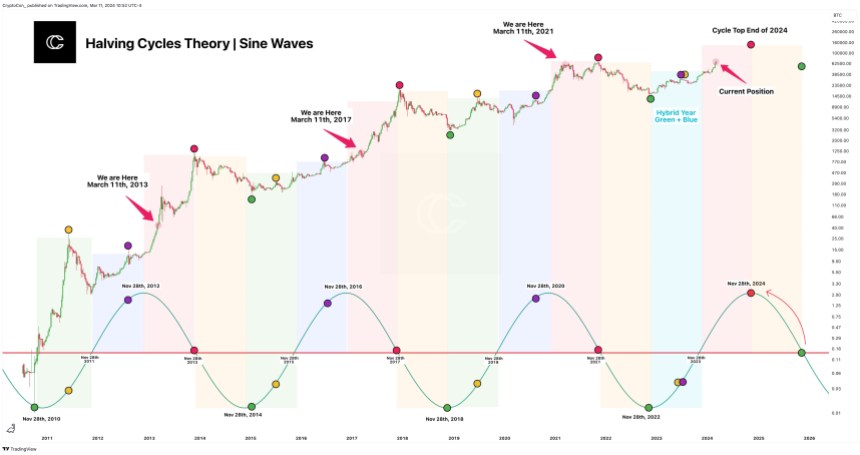

By analyzing earlier halving cycles and the “acceleration” noticed within the present cycle, Rekt Capital suggests that Bitcoin’s bull market might peak inside 266-315 days from breaking its previous all-time excessive, doubtlessly occurring in December 2024 or February 2025.

Rekt Capital’s evaluation reveals that Bitcoin has traditionally peaked in its bull market roughly 518-546 days after a halving occasion. Nevertheless, the present cycle demonstrates accelerated progress, lowering roughly 260 days.

In response to the analyst, this acceleration has the potential to halve the standard cycle size, indicating that Bitcoin’s peak within the present bull market might happen a lot before anticipated.

Rekt Capital’s perspective, measuring the bull market peak from when an previous all-time excessive is breached, supplies invaluable insights. On this cycle, Bitcoin just lately broke to new all-time highs, indicating a possible milestone available in the market.

If the accelerated perspective holds, the following bull market peak is estimated to happen inside 266-315 days from this breakout, touchdown someplace between December 2024 and February 2025, in response to the evaluation supplied by Rekt.

Roughly each 4 years, Bitcoin’s halving occasions have traditionally performed a vital position in shaping market cycles. These occasions cut back the block reward miners obtain, thereby lowering the speed of latest Bitcoin provide, however this time could also be totally different, in response to Rekt, one other analyst.

From 4-12 months Cycle To New Horizons

Much like Rekt’s evaluation, market knowledgeable Crypto Con means that the “typical four-year cycle” might now not maintain, as Bitcoin is reaching new all-time highs before anticipated, and as such, Crypto Con believes that the “boundaries of the standard cycle” are being pushed, doubtlessly signaling a paradigm shift in Bitcoin’s market dynamics.

Traditionally, Bitcoin’s value cycles have adhered to a four-year sample, characterised by market peaks round 4 years after every halving occasion. Nevertheless, Crypto Con challenges this notion, arguing that the present cycle deviates from the “conventional timeline.”

Bitcoin’s latest entry into “value discovery mode” and the achievement of latest ATHs roughly a 12 months sooner than anticipated recommend that the four-year cycle might now not maintain its predictive energy.

Crypto Con’s evaluation signifies that the present market trajectory aligns extra carefully with the 2017 bull run than with earlier cycles. Evaluating the primary tops of cycles 1 and three (2013 and 2021) to the current, each situations had been on the verge of forming their preliminary peaks round April, mirroring the present market situations.

This commentary helps the opportunity of Bitcoin’s subsequent bull market peak occurring in late 2024 reasonably than the beforehand anticipated late 2025.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual danger.

[ad_2]